Introduction

The Eastern Transportation Coalition (TETC), spanning 19 states and the District of Columbia, is dedicated to fostering connectivity and enhancing safety and efficiency across various modes of travel within the public sector. In their recent report called “Initial TDM Validation Activity: Origin-Destination Core Data”, TETC conducted an extensive evaluation of origin-destination data from four of its approved data vendors featured on the TETC Transportation Data Marketplace, with AirSage being one of the key participants.

Data Validation Process

TETC's assessment involved two key components. The first was a completed questionnaire about the data providers’ methodology, data characteristics, data access/privacy, and data resiliency. The second was a set of sample origin-destination (O-D) data for Richmond, Virginia filtered by custom traffic analysis zones (TAZs), date range of October 2022, day type, and day part. Other filters included vehicle type, vehicle class, and trip characteristics.

Results

Questionnaire

A summary of the questionnaires revealed various differences between the four data providers. Key distinctions included varying data sources, the representation of average versus total trips, the provision of intersection-level origin-destination data, methods for data request, and the level of disruption anticipated in the event of the unavailability of primary data sources.

Sample Data

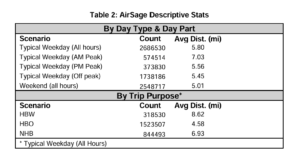

The four providers generated generally consistent results from the sample data with minor deviations. Notably, Inrix, Streetlight, and AirSage displayed very similar figures for trip count, average trip distance, and average travel time when segmented by Day Type & Day Part and respective vendor-specific filters. Conversely, Geotab's data diverged the most, likely ascribed to its exclusive reliance on commercial fleets as the primary data source.

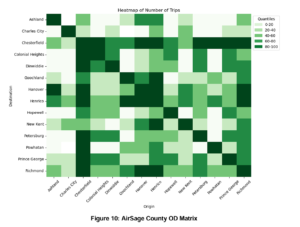

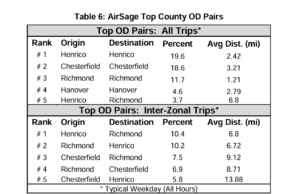

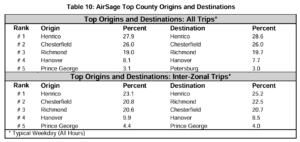

Furthermore, the evaluation encompassed other data comparisons, including visualizations of the County Level OD Matrices, Top O-D Pairs at County Levels, and Top Origin and Destinations at County Level. Here too, Streetlight, Inrix, and AirSage exhibited closely aligned data patterns. Geotab emerged as the outlier once more, presumably due to its lack of supplementary data sources beyond commercial fleets.

In recounting the customer experience with AirSage during the sample data acquisition process, TETC commended the streamlined nature of data procurement, stating:

“Overall, the process of acquiring data was streamlined. The upfront meeting with AirSage helped clarify issues right away, and the fact that AirSage runs queries on the user’s behalf means that the user does not have to be concerned about understanding nuanced (and potentially impactful) parameter settings.

TETC's Takeaways

At the end of the report, TETC noted key takeaways from the evaluation of the four data providers which are quoted below:

Report Updates and Clarifications

Since the publication of this report, several updates have taken place at AirSage:

Methodology: Data Sources and Travel Modes

The original report noted that AirSage could not distinguish between travel modes within its LBS data, suggesting the absence of pedestrian or bicycle insights. However, as of June 2024, AirSage now provides Pedestrian Activity Density data, which identifies areas of high non-motorized activity by capturing mobile devices that travel under 1.5 meters per second within a defined study area. Organizations are already applying this data in Safe Streets and Roads for All (SS4A) initiatives and pedestrian and bicycle plans.

Data Access and Privacy

The report previously stated that AirSage data could only be requested through consultation and delivered via a CSV download link. As of April 2024, AirSage launched the AirSage Transportation Platform, a user-friendly interface for accessing, visualizing, and downloading mobility data. This platform enhances the flexibility of data access while maintaining high standards for data privacy and security.

Resiliency

The report stated that AirSage has demonstrated resilience by its ability to recover quickly from losses in the past - specifically, the market disruption in April 2022. To illustrate this resilience, AirSage detailed the evolution of its data panel's composition, emphasizing device quality, source reliability, and panel size in a comprehensive article. The release of the study "LBS Data is Not Dead (Part 2): A Study of Actual Traffic Events Using AirSage LBS Data" further substantiates this narrative and reaffirms the high caliber and reliability of AirSage's LBS data offerings.

Conclusion

The Eastern Transportation Coalition's (TETC) evaluation of origin-destination (O-D) data providers within the TETC Transportation Data Marketplace has offered valuable comparisons and insights. Through a detailed questionnaire and analysis of sample data for Richmond, Virginia, the report highlights the distinct capabilities of four major providers: AirSage, Inrix, StreetLight, and Geotab.

However, the report did not reflect several recent advancements at AirSage. Notably, the introduction of Pedestrian Activity Density data represents a significant advancement in capturing non-motorized mobility trends. Additionally, the launch of the AirSage Transportation Platform in 2024 has made accessing and visualizing mobility data more intuitive and efficient. These updates, along with continued validation of AirSage’s high-quality Location-Based Services (LBS) data, reinforce the company’s reputation as a reliable, forward-thinking leader in the transportation industry.

To explore AirSage’s full origin-destination data offering within the TETC Transportation Data Marketplace, visit: https://airsage.com/tetc/